A temporary reduction in the rate of stamp duty on house purchases has been introduced by Chancellor Rishi Sunak, as one of several measures designed to stimulate the economy following the three-month Covid-19 lockdown. The stamp duty “holiday” will last for nine months, from 8th July to 31st March 2021, and the tax will now only be levied on purchases of main residence properties costing over £500,000. A graduated scale of stamp duty will apply to properties valued above this figure.

Prior to this announcement a rising scale of stamp duty was applied to any property costing over £125,000, and it is estimated that the new rules could save buyers as much as £15,000 on a property purchase of £500,000 and above. The £300,000 stamp duty threshold for purchases by first time buyers has been removed under the new plan, and although landlords and second home owners will still have to pay the additional 3% of stamp duty carried over from the previous taxation rules they will also now benefit from the other changes announced by the Chancellor.

Mr Sunak claimed that the average bill for stamp duty will fall by £4,500, and that nearly 9 out of 10 home buyers will pay no stamp duty at all during the next nine months. Although the changes in duty will not be backdated to cover home purchases made during the lockdown, the tax is paid only on completion and so if purchasers have exchanged contracts but not yet completed they will still benefit from the revised duty.

Figures from HM Revenue and Customs reveal that the changes will cost the Treasury around £3.8bn out of the annual stamp duty take of £12bn. Jamie Ward, head of stamp taxes at services group PwC said: “The stamp duty holiday might have a positive impact on a long list of related industries, such as house builders, conveyancers, estate agents, finance and insurance providers, house movers and furniture and garden retailers.” Critics have, however, queried the length of the stamp duty holiday, particularly in light of the time needed for construction projects to come to the market, as well as the distortion of the market that a short-term boom in sales will bring.

For more information go to: Stamp Duty Land Tax: temporary reduced rates

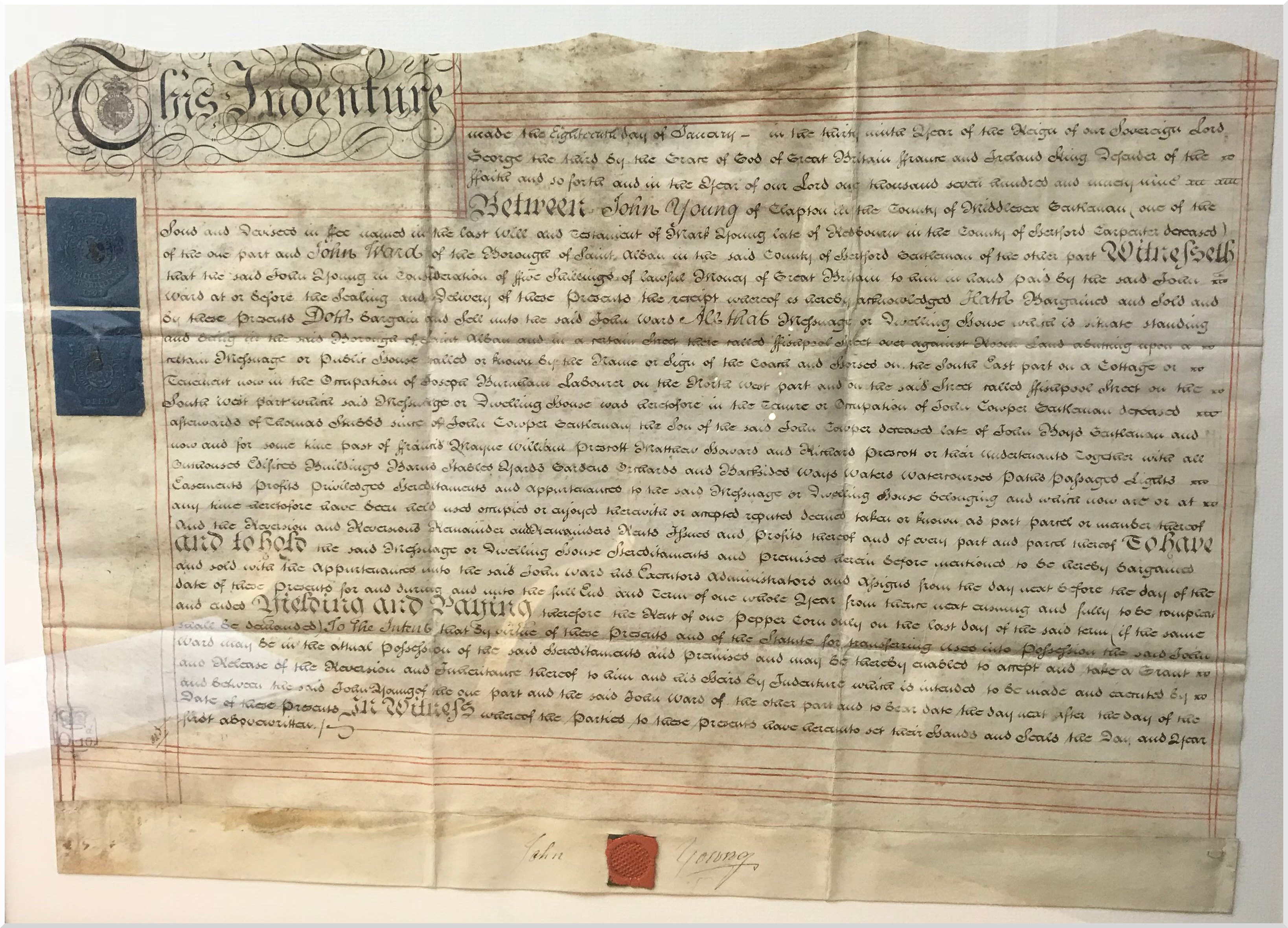

Bretherton Law have been serving the people of Hertfordshire for over 50 years. Our team of experienced Property Lawyers will ensure that whether you are buying or selling, the conveyancing process will run smoothly and professionally. We offer a same day response promise as well as fixed fee quotes. Bretherton Law are accredited under the Lexcel legal practice and the Law Society’s Conveyancing Quality Schemes. Call 01727 869293 or use the contact form below.