The Bank of Mum and Dad (BoMaD) has now become an essential source of funds for many people when buying a home. In fact, over the last 12 months so many people have taken advantage of family members for property loans that collectively, the Bank of Mum and Dad now accounts for £6.3 billion worth of loans – enough for it to overtake Clydesdale Bank at 10th place in mortgage lender rankings.

A report by the Insurance and Pensions group L&G claims that the average parental contribution to home buying this year stands at £24,100 (£31,000 in London), an increase of over £6,000 on the previous 12 months. The report also states that the total figure is up by over 10% from the £5.75 billion of lending in 2018. The contribution of BoMaD easily outstrips government schemes to ease the problem of housing affordability. The longest-running and best known scheme, the Help to Buy equity loan, has so far helped fewer people to buy property than BoMaD does in a single year.

The overall number of property transactions helped by BoMaD may have fallen in the last 12 months, in line with the general slowing of the housing market, but BoMaD will still help to buy nearly £70 billion worth of property in 2019. This equates to more than a quarter of a million buyers, and one in five property purchases this year (two out of every five in London).

Unsurprisingly, the majority of those getting parental help are young people, with 62% of under-35s accepting gifts and loans in order to afford their most recent house purchase. This simply reflects the upward march of property prices during a period of relatively stagnant wage rises. More surprising is that according to L&G, 36% of 35 to 44 year olds say they have received parental help to buy their current home, as have 22% of 45 to 54 year olds.

While anything that helps people to get on, or progress up, the housing ladder should be seen in a positive light, there are also drawbacks which BoMaD lenders should consider. With people living longer and healthier lives parents need to ensure they will still have sufficient funds to support their retirement years once they have given over loans to their family members. To fund the transfer of money to their children over half of lenders will draw on their cash savings, while 21% take money from ISAs. Those without such savings will resort to cashing in their pensions as a lump sum (9%), using equity release (16%), downsizing their own property (14%), or even taking on extra borrowing themselves (6%).

The L&G report found that over a quarter of those surveyed feared they had insufficient funds to last through their retirement. Additionally, 15% said that they had already accepted a lower standard of living in order to help out their children. Clearly, not everyone in society will be able to take advantage of the Bank of Mum and Dad, and the net result of BoMaD lending may only widen the gulf between the haves and have-nots.

Whatever position they are in, BoMaD lenders should think long and hard about their own circumstances, and take appropriate independent legal advice as well as consulting their financial adviser.

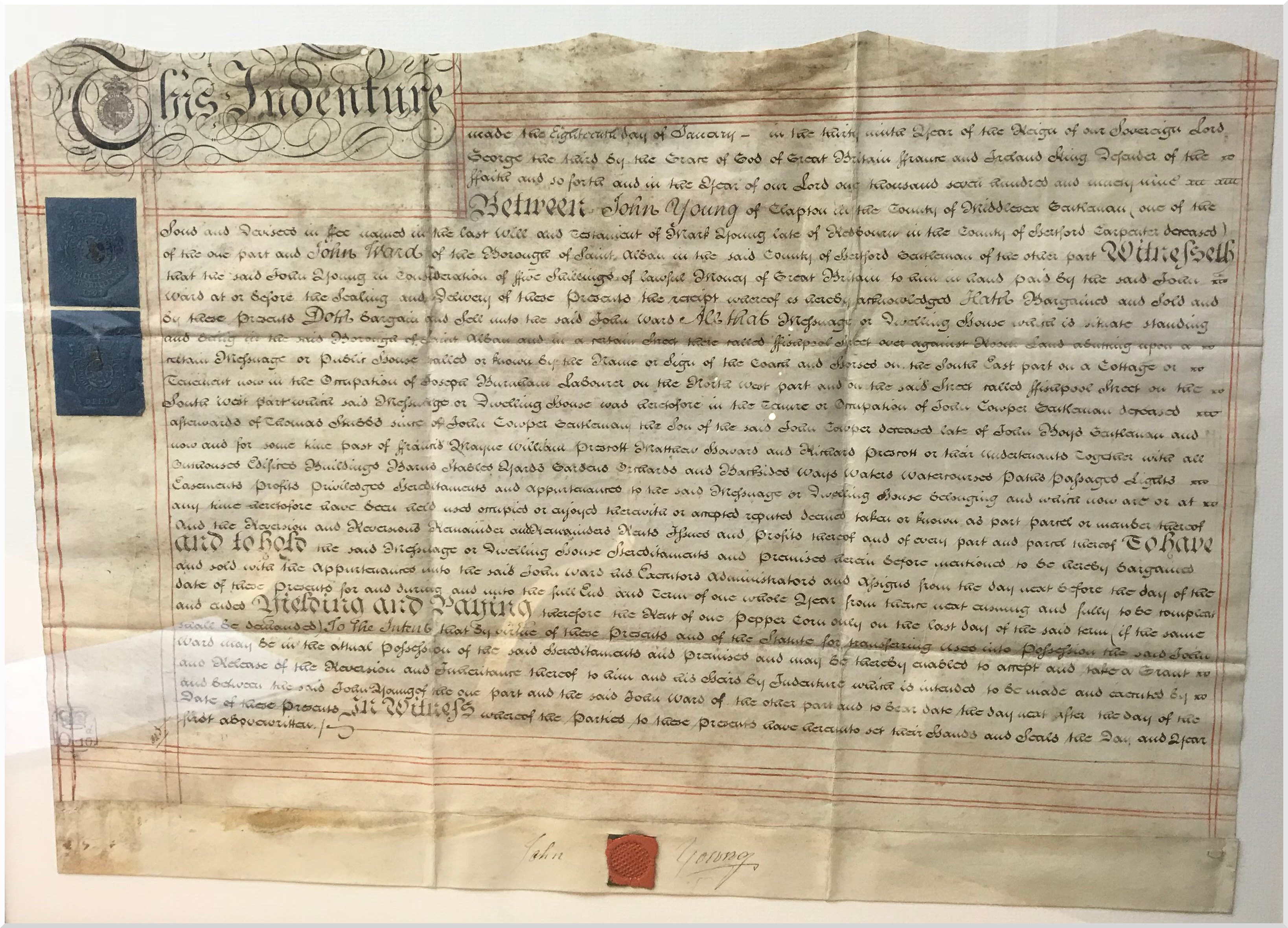

Bretherton Law have been serving the people of Hertfordshire for over 50 years. Our team of experienced Property Lawyers will ensure that in every transaction, the conveyancing process will run smoothly and professionally. Contact Lucy Madley on 01727 869293.

Related Articles

Legal and General: The Bank of Mum and Dad Report